The competition in China's electric vehicle market intensifies, the midterm report card of Chinese car companies is released!

AshleyJul 04, 2024, 10:25 AM

AshleyJul 04, 2024, 10:25 AM

As the curtain slowly falls on the first half of 2024, major Chinese car brands have also announced their mid-year sales reports. Among them, BYD has accumulated sales of over 1.6 million units in half a year, ranking among the top ten car manufacturers in the world; CHERY Group has exported over 530,000 units in half a year, ranking first for 22 consecutive years; Hongmeng Zhixing has delivered over 190,000 units in half a year, surpassing LI Auto to become the sales champion of the new car manufacturing force. In addition, car companies such as GEELY, CHANGAN, NIO, ZEEKR, and LEAPMOTOR have also achieved record high delivery volumes in the first half of the year, which demonstrates strong market competitiveness.

The continuous and stable growth of Chinese independent car companies cannot be separated from the explosion of the electric car market, which has become a new growth point. According to data released by the Passenger Car Association, China's passenger car market sold a total of 8.073 million units in January-May 2024, an increase of 5.7% year-on-year. Among them, the cumulative retail sales of new energy passenger vehicles reached 3.255 million, an increase of 34.4%, and the penetration rate reached 40.32%, an increase of 4.6 percentage points compared with 2023.

If this pace continues, the penetration rate of new energy vehicles in China will reach 45% in 2024. With the new energy penetration rate reaching 47% in May this year, it is expected that the penetration rate of new energy passenger vehicles will break through 50% in July-August, leaving less and less time for fuel vehicles.

Let's take a look back at the first half of 2024 and take a close look at the mid-year sales performance, annual sales target achievement rate, and product planning and market layout for the second half of the year for Chinese independent car companies.

BYD's cumulative sales in the first half of the year were 1,607,145 units

Annual sales target progress 44.64%

In the case of traditional car companies, BYD is still unsurpassed by other companies. In 2022 and 2023, BYD achieved remarkable results in the field of electric vehicles, becoming the sales champion of Chinese car companies for two consecutive years and being ranked in the top 10 global car brand values for two consecutive years.

In the first half of 2024, the cumulative sales volume of BYD passenger cars reached 1,607,145, an increase of 28.76% year-on-year. According to the annual sales target of “at least 20% growth” set by Wang Chuanfu, the chairman of BYD — That is, the annual sales exceed 3.6 million units, the current completion rate is 44.64%. If the current growth momentum can be maintained, it will not be difficult to achieve the sales target this year. Moreover, BYD will launch many new models in the second half of the year, which will further enhance its market share.

Looking at the various series and sub-brands under BYD carefully, in the first half of this year, the cumulative sales of BYD Dynasty were 781,897, an increase of 17.81% year-on-year. According to the annual sales target of 1.7 million, the current progress is 45.99%; The cumulative sales of BYD Ocean Network are 741,684, an increase of 40.84% year-on-year. According to the annual sales target of 1.6 million, the current progress is 46.36%.

The DENZA brand sold a total of 59,565 units in the first half of the year, a year-on-year increase of 4.96%, and the current progress towards the annual sales target of 200,000 units is 29.78%. The FANGCHENGBAO brand sold a total of 18,283 units in the first half of the year and the YUANGWANG brand sold a total of 5,500 units in the first half of the year, these two high-end brands have not announced their sales targets.

Chery Group's cumulative sales volume in the first half of the year is 1,100,621 units

Annual sales target progress 51.77%

In the first half of 2024, CHERY sold a total of 1,100,621 cars, up 48.4% year-on-year, breaking the one million mark for the first time in half a year and setting a new historical record. Among them, a total of 532,158 cars were exported in the first half of the year, an increase of 29.4% year-on-year, accounting for nearly half of the total sales. CHERY has been the number one exporter of Chinese brand passenger cars for 21 consecutive years.

In 2024, CHERY will take "sales growth rate exceeds the industry by 10-20 percentage points" as the annual target. According to Chen Shihua, deputy secretary-general of the China Automobile Association, it is predicted that the growth rate of China's total car sales in 2024 will be more than 3%. This means that CHERY's sales growth rate this year is between 13%-23%, that is, the annual sales volume is above 2.126 million - 2.314 million units. If calculated based on the annual sales target of 2.126 million cars, the current progress is 51.77%, which is the highest among all car companies. Even calculated based on 2.314 million cars, the progress has reached 47.56%.

The main reason that CHERY can maintain high-speed growth is due to significant progress in the field of electrified cars. From January to June this year, CHERY sold a total of 180,947 new energy vehicles, up 181.5% year-on-year, which is the highest growth rate among traditional car companies.

GEELY's cumulative sales in the first half of the year were 955,730 units

Annual sales target progress is 47.79%

In the first half of 2024, GEELY's cumulative sales were 955,730, an increase of about 41% year-on-year. Among them, the cumulative sales of electrified cars were 320,185, an increase of about 117% year-on-year, second only to BYD, which is a new historical high. According to the sales target of 1.9 million units set at the beginning of the year, the current progress is just over half, second only to CHERY. However, due to better performance than expected, GEELY official decided to increase the annual sales target by about 5%, which is an increase from 1.9 million units to 2 million units, so the actual progress is 47.79%. Considering the current growth momentum, it is highly likely to achieve the goal.

Specifically in terms of brands, GEELY had a total sales volume of 741,860 in the first half of the year, an increase of more than 34% year-on-year; LYNK&CO's total sales volume in the first half of the year was 64,072, a year-on-year decrease of 21.9%. It is the worst performer in GEELY, mainly because its products are currently being updated. And it is believed that with the bulk delivery of LYNK&CO 07 EM-P and the launch of LYNK&CO Z10, sales are expected to improve; ZEEKR delivered a total of 87,870 in the first half of the year, a year-on-year increase of 106%. As a new force brand that only sells pure electric products, this achievement is quite remarkable. ZEEKR's sales target for 2024 is 230,000 units, and the current progress is 38.2%.

CHANGAN electric vehicle cumulative sales of 290,000 units

Annual sales target progress 39.87%

CHANGAN only announced the sales volume of its own brand electric vehicles. The cumulative total for the first half of 2024 was 290,000 units, an increase of more than 69% year-on-year. This growth rate is much higher than the industry average. However, according to the previously established sales target of 750,000 units for electric vehicles, the current progress is 39.87%, which has not yet reached half of the journey.

GWM's total sales volume in the first half of the year was 559,669 units

Annual sales target progress 34.98%

In the first half of 2024, GWM had a cumulative sales of 559,669 vehicles, a year-on-year increase of 7.79%, of which the cumulative sales of electrified vehicles were 132,374, a year-on-year increase of 41.99%; The total overseas sales was 201,500, a year-on-year increase of 65.59%. According to the annual target of 1.6 million vehicles set at the beginning of the year, the current progress is only 34.98%. This data is not only at the end of the scale among traditional automotive companies, but also only in the middle and lower level among new brand forces. This reflects that there may still be some deficiencies or challenges in GWM's overall market layout, product line planning, marketing strategy, etc. More strong measures need to be taken in the second half of the year to promote sales growth.

Specifically, the HAVAL brand had a cumulative sales of 299,738 vehicles in the first half of the year, a year-on-year increase of 2.42%; The WEY brand had a cumulative sales of 19,867 vehicles in the first half of the year, a year-on-year increase of 9.46%; TANK's cumulative sales in the first half of the year were 116,038 vehicles, a year-on-year increase of 98.94%; The ORA brand had a cumulative sales of 31,749 vehicles in the first half of the year, a year-on-year decline of over 30%; GWM pickup had a cumulative sales of 91,916 vehicles in the first half of the year, a year-on-year decline of over 8%. From the market performance feedback, we can clearly see the growth differences and market trends between different brands.

Xiaomi Auto's cumulative delivery exceeded 25,000 units in the first half of the year

Annual delivery target progress 25%

In the first half of 2024, Xiaomi Auto's cumulative delivery exceeded 25,000 vehicles. Among them, 7085 units delivered in April, 8,646 vehicles delivered in May and delivery in June broke 10,000. The specific number has not yet been announced, but the official stated that the delivery in July will continue to break 10,000. Previously, Xiaomi's founder and chairman, Lei Jun, promised that a minimum of 100,000 units will be delivered by the end of 2024, with a sprint for 120,000 units. If calculated based on 100,000 units, the current progress is 25%. If the annual delivery target is to be achieved, the average monthly delivery in the second half of the year needs to be 12,500 units, which is a great challenge for Xiaomi Auto's production capacity.

Currently, it is known from the Xiaomi Auto APP that purchasing the SU7 now requires a waiting period of 21-32 weeks(approximately 5-7 months), with the earliest delivery in late November and the latest in early February.

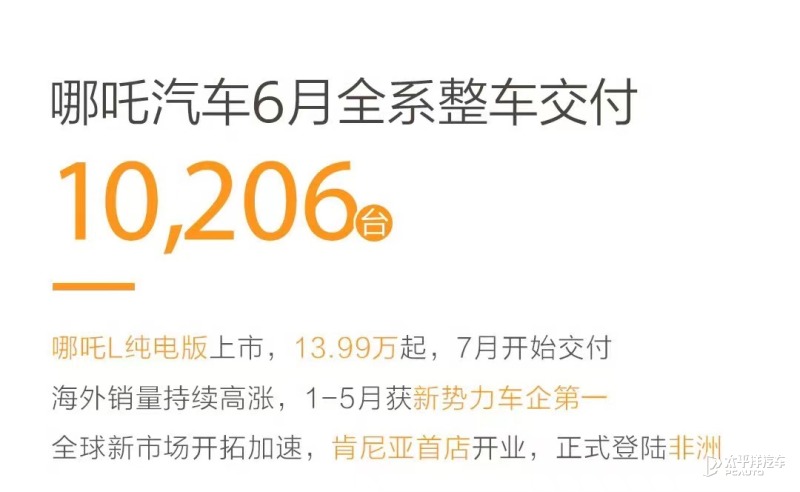

NETA's cumulative sales in the first half of the year are 53,770 units

26.89% progress towards the annual sales target

In the first half of 2024, NETA's cumulative sales were 53,770 units, with June sales of 10,206 units, a year-on-year decrease of 15.9%, a month-on-month increase of 0.9%. Overall performance was quite struggling but still has potential. According to the annual sales target of 200,000 units, the current progress is 26.89%.

Conclusion

Looking at the report cards published by major auto companies, the overall performance indeed presents a fairly positive trend, with a year-on-year growth generally exceeding 20%, even over 50% and even doubling. It also reflects the increasing acceptance and recognition of Chinese brand car companies and electrified models by consumers.

As for the slow progress in sales targets, it is mainly because auto manufacturers were too optimistic when setting sales targets and failed to fully consider factors such as market competition, supply chain bottleneck, and changes in consumer demand that affect the achievement of sales targets.

If any infringement occurs, please contact us for deletion

Toyota Tundra Owner Achieves the Second Million-Mile Milestone

[PCauto] The mileage often measures the quality and durability of a car, and Victor Sheppard and his two Toyota Tundra pickups have set a staggering record.With Victor Sheppard's dedication and careful maintenance of the Toyota Tundra, he successfully drove two different Tundra pickups over 1 million miles (approximately 1,609,340 kilometers).In 2007, Sheppard bought a brand new Toyota Tundra CrewMax. Over the next nine years, as a contractor, he worked across the United States, from Louisiana t

BYD Plans to Promote 1000V High Voltage Super Charging Stations and Its Models on a Large Scale

【PCauto】Recently, the news that BYD plans to massively implement a 1000V high-voltage supercharging platform has attracted widespread attention. It is reported that this platform will be launched in the middle of March this year and supports super-fast charging above 5C. After its release, it will quickly be popularized to its own models and large-scale construction of 1000V supercharging stations.This move will undoubtedly set off a wave in the new energy vehicle market. Let's delve into the te

XPENG G9 is about to be launched in China, bringing 66 upgrades in features

【PCauto】XPENG has recently announced that the 2025 XPENG G9 will soon be launched in China. Although the official did not announce the time and price, the success of XPENG G6 and X9 has rekindled expectations for the once-failed G9 by XPENG. In terms of appearance, the G9 continues the X-BOT FACE 3.0 design language, with a closed grill at the front paired with split-style headlights on both sides, new two-tone collision colors and all-black body styles, with a petal-style wheel hub. Combining

BYD YANGWANG U7 Launches with World's First Suspension Charging Tech

[PCauto] On March 27, BYD YANGWANG U7 was launched, with two power versions of pure electric and plug-in hybrid, a total of four models. YANGWANG U7 EV Five-seater Luxury Edition, priced at about 292.85 million baht/RM38.31 YANGWANG U7 EV Four-seater Flagship Edition, priced at about 330.04 million baht/RM43.19 YANGWANG U7 PHEV Five-seater Luxury Edition, priced at about 292.85 million baht/RM38.31 YANGWANG U7 PHEV Four-seater Flagship Edition, priced at about 330.04 million bah

What will the new Perodua Car look like in 2025? What kind of changes will they undergo?

【PCauto】In 2025, Perodua will introduce a series of anticipated new car dynamics, covering the launch of new models and remodeling of several existing models, whether in the bold step in the field of electrification or in the optimization of classical models.Perodua is to launch its first electric car in 2025Perodua's first pure electric car is expected to go on sale officially in the fourth quarter of 2025. To ensure the vehicle's performance and quality, Perodua may initiate testing work as ea

Popular Cars

Car Compare