Toyota's electrification fate remains a mystery, nearly 30 years of hybrid technology could become a mere shadow

JohnDec 11, 2024, 06:14 PM

JohnDec 11, 2024, 06:14 PM

In the five days following the opening of the Motor EXPO 2024, 13,801 car orders were successfully placed on-site. Against the backdrop of more than 17 consecutive months of declining car sales in Thailand, this is an impressive figure. However, it is not enough to reverse the domestic automotive market's downturn.

Faced with the severe situation in the automotive market, Noriaki Yamashita, the head of Toyota Thailand, issued a plea for government support during an interview, urging the government to strengthen its support for electric vehicles (EVs). This includes not only Battery Electric Vehicles (BEVs) but also Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), and other vehicles powered by renewable energy.

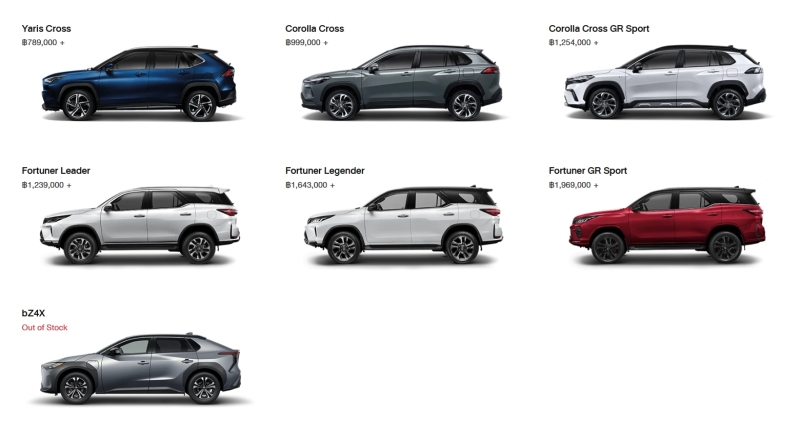

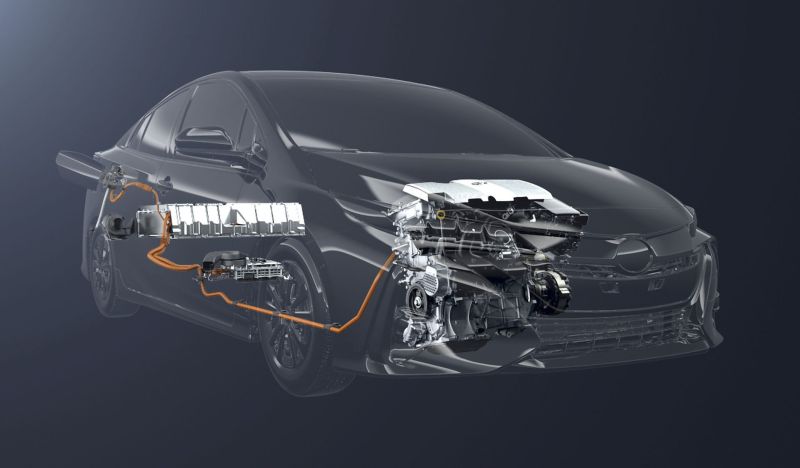

However, Toyota’s commitment to electrification in Thailand doesn't seem as strong as Noriaki Yamashita has made it out to be. Currently, Toyota only imports the bZ4X electric vehicle to Thailand (and it's still in short supply), while other HEV models are still using the THS technology, with no further electrification plans in sight.

The government has not made any statements on this, as they are more concerned about Toyota potentially halting further investment in the country.

However, the government hasn’t let Toyota’s stance stop its drive for automotive electrification. Instead, it has opened its doors to Chinese carmakers, given China’s significant success in electric vehicles. According to the latest sales data, China's EV market share has reached 50.1%, with BEVs alone accounting for 31.1%.

Chinese carmakers, just as the government expected, have actively invested in Thailand. Over the past two years, Thailand's automotive market landscape has subtly changed, with Japanese brands gradually losing market share. In 2022, Japanese brands held 86% of the market; by 2023, that number had dropped to 75%.

Meanwhile, the market share of Chinese car brands in domestic sales has risen from 5% in 2022 to 11% in 2023. In the market for electric vehicles, Chinese car brands have a market share of up to 80%.

Take BYD as an example, starting from January 2023, BYD has won the championship of domestic pure electric vehicle sales for 18 consecutive months. Now, one out of every three pure electric vehicles sold is BYD's, with a market share of up to 41%.

The success of Chinese carmakers in the domestic market was expected because they have achieved a dominant victory over Japanese brands in China.

In the last three years, Japanese automakers such as Toyota, Nissan, Honda, and Volkswagen have seen their market share in China drop from 22.3% to 13.9%. This decline will likely continue. Why is this happening?

The reason is that more fuel-efficient and cheaper Chinese cars have entered the market.

Noriaki Yamashita also admitted that Chinese cars have a strong price advantage. After the emergence of BYD DM-i hybrid technology in 2020, Toyota's sales in China had been declining, so Toyota, Nissan, Honda, and Volkswagen were forced to participate in a price war.

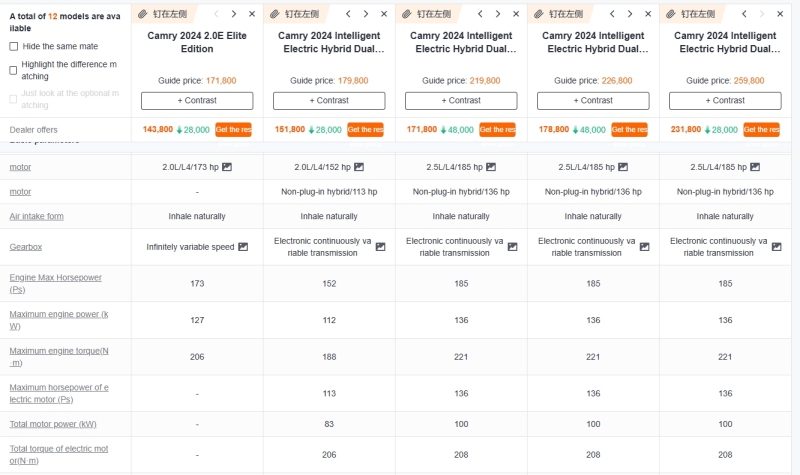

The most common Toyota Camry has undergone multiple price reductions in China. The current actual price is only half of that in Thailand.

Take the Toyota Camry as an example: in China, the price of a 2.5L hybrid Camry is around 805,329 THB, while the same car in Thailand costs 1,455,000 THB.

To further enhance price competitiveness, Toyota still needs to offer a fuel-powered version of the Camry in China, with a price as low as 674,076 THB.

Despite these price adjustments, Camry’s sales in China in November 2023 were 16,798 units, representing a 23% drop compared to the same period last year.

It’s not just the Camry that has become cheaper. In China, almost all cars are priced very competitively.

In 2023, a German car dealer secretly imported a Volkswagen ID.3 from China and sold it back in Germany. They found that the ID.3, produced by Volkswagen, was priced at €40,000 in Germany, but only €15,000 in China. Even after paying taxes, it was still profitable to import and sell it in Germany.

This explains why, even in a globally deteriorating economy, China's car sales continue to grow. At the same time, in Thailand, the automotive market is shrinking due to high levels of household debt and the high cost of cars. The expensive prices of cars have made it harder for banks to approve car loans, with approval rates plummeting.

Despite having a much longer automotive history than China, with a mature and well-established automotive supply chain that has already lowered costs, car manufacturers in Thailand still sell cars at high prices because they lack strong competition in the domestic market!

However, this situation will not last long, as Chinese carmakers are increasingly penetrating the Thai market. At the Motor EXPO, it was evident that the display areas of Chinese carmakers had surpassed those of other countries, covering a total of 60,000 square meters.

Moreover, Chinese carmakers have also changed their marketing strategies. In the past, they only brought popular Chinese models to Thailand, such as the BYD Dolphin, BYD SEAL, DEEPAL S07/L07, and Xpeng G6.

Now, they are better understanding the Thai market and launching electrified pickup trucks, such as the DEEPAL E07, GWM POER SAHAR, RIDDARA RD6, and BYD SHARK6.

In response to these moves by Chinese carmakers, Noriaki Yamashita, Toyota's head, stated that Toyota will also launch an electrified pickup truck by the end of next year. He also believes that Chinese carmakers' price advantage will only be in the BEV segment, while Toyota still has the upper hand in other areas.

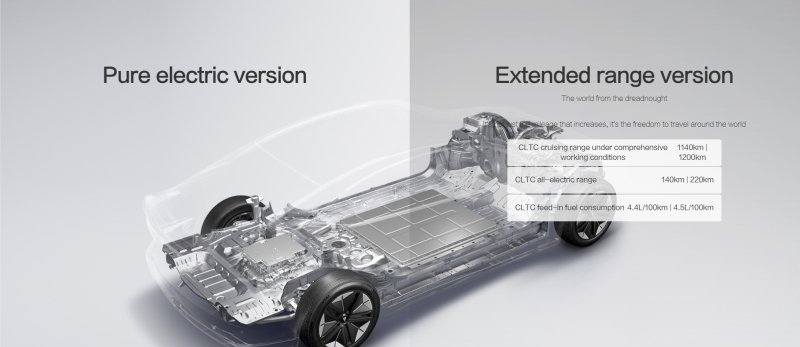

However, this is not entirely accurate. Efficiency is the key to Chinese carmakers' advantage, and their price advantage will soon spread to other electrified vehicle segments. While designing BEVs, Chinese carmakers also consider the engine placement needed for PHEVs. Therefore, when they launch a pure electric vehicle, it is likely to have a hybrid version as well.

In the Chinese automotive market, annual sales and production both exceed 20 million vehicles. The large-scale market and fierce competition are pushing every Chinese automaker to update their technology faster.

Take BYD's QIN L DM-i as an example: the DM-i technology has already reached its fifth generation, and now, with a single tank of fuel, the car can travel over 2,000 kilometers. BYD has also removed the 12V lead-acid battery, which had been a part of vehicles for over a century, meaning consumers no longer need to replace the lead-acid battery. While reducing costs, the car’s power is also more efficient than Toyota’s THS, while being more fuel-efficient.

The Toyota Corolla equipped with THS accelerates from 0-100 km/h in about 10 seconds, with a fuel efficiency of 23.26 km per liter.

While QIN L uses a 1.5L naturally aspirated engine, it only needs 7.9 seconds to accelerate from 0 to 100 km/h, and can travel 27.03 kilometers per liter of fuel.

Additionally, the QIN L supports 55 km of pure electric range, meaning that for short trips, it doesn’t consume any gasoline, offering significant savings compared to the Corolla with THS.

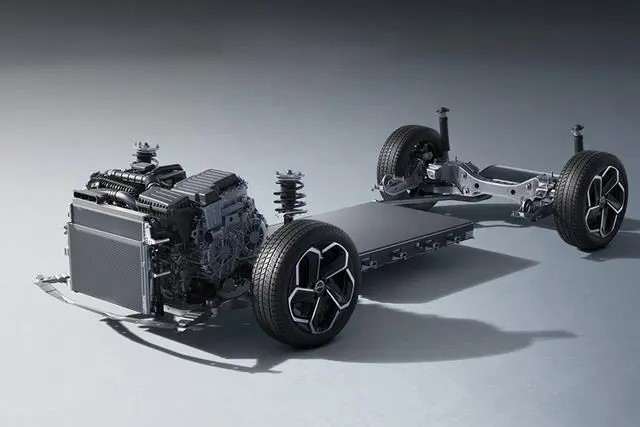

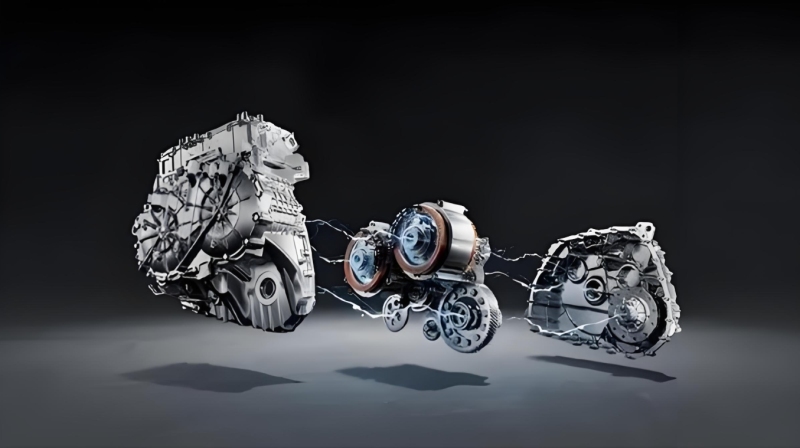

Besides BYD’s DM-i system, other Chinese carmakers have also developed “DHT hybrid technology” (DHT: Dedicated Hybrid Transmission), which focuses on better performance, typically with 2-3 AT gear ratios.

For example, GWM and Chery's DHT-PHEV use a 2-speed DHT gearbox, while Geely’s DHT hybrid structure uses a 3-speed design. In terms of hybrid technology alone, Chinese carmakers offer many different technical routes.

As Elon Musk once said about Chinese carmakers: "Without trade barriers, Chinese carmakers can defeat any automaker in the world." The reason is that Chinese carmakers have much higher operational efficiency.

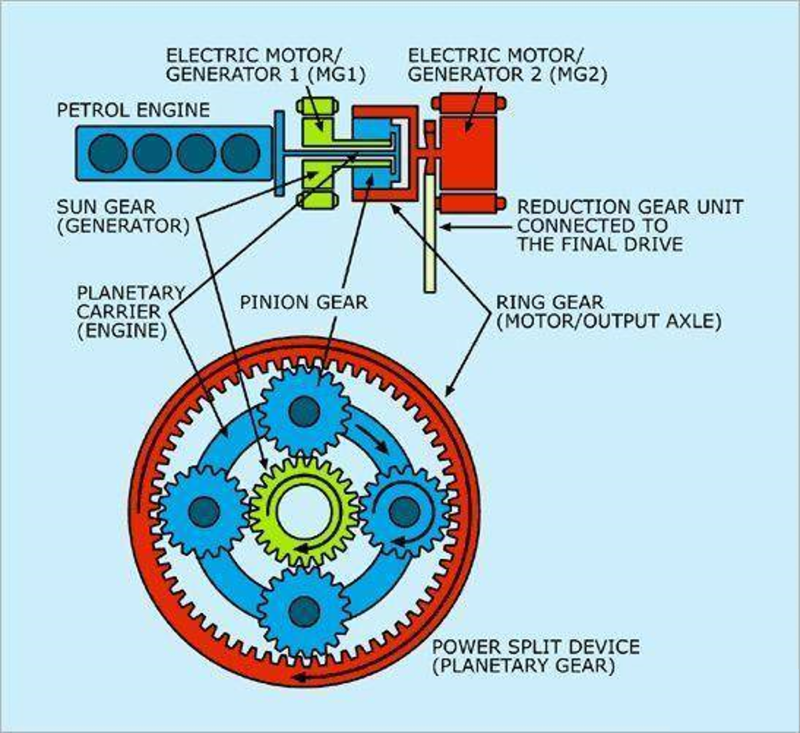

In contrast, Toyota is a large, traditional multinational company, and its actions are much slower. Toyota introduced the Prius with THS technology back in 1997, and after nearly three decades of development, the improvements to THS have been minimal, mainly limited to changing the positions of the MG1 and MG2 motors. Perhaps the THS system is so well-constructed that it hasn’t required significant modifications.

Another critical issue is that THS is not well-suited to the electrification trend. THS tends to consume more fuel at high speeds. It doesn’t perform better than traditional gasoline engines.

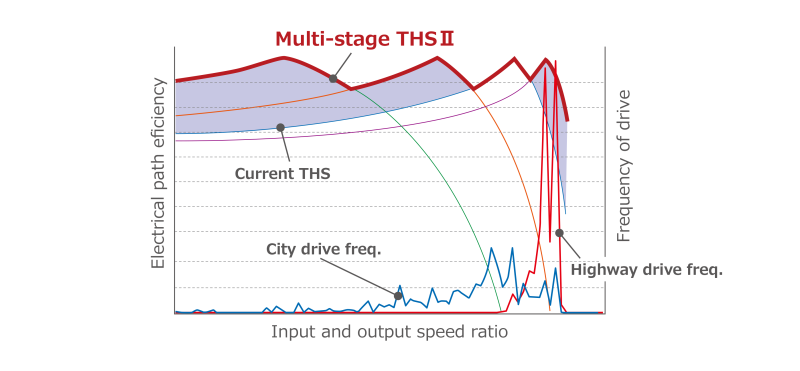

Early THS systems (P111, P112) have shown this flaw: when the car runs at speeds above 80 km/h, the gear speeds of the E-CVT are too high, and part of the engine’s power is lost between the MG1 and MG2 motors rather than being transferred to the wheels, resulting in lower efficiency and higher fuel consumption. This issue worsens with higher speeds.

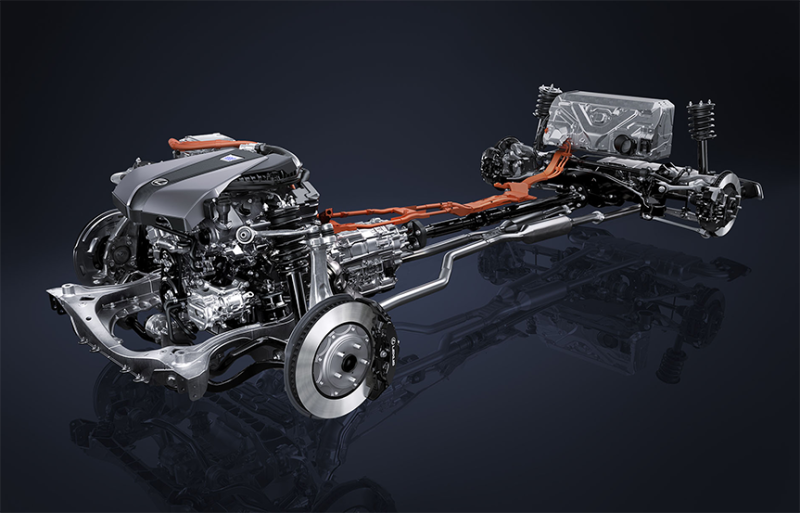

On some models that require power, such as the LEXUS LS 500H and the Sixteenth Generation CROWN Sedan, Toyota will add an extra set of 4AT transmissions, forming the Multi-Stage THS Ⅱ, to alleviate the problem of ineffective power cycling of THS.

In the past, THS was a very effective system. It was simple, efficient, and has been installed in over 27 million cars globally, but that was in the era of gasoline vehicles. In the era of automotive electrification, the future of THS looks uncertain. Moreover, the prices of cars equipped with THS have always been higher than those of their gasoline counterparts.

As consumers, we now demand cars that offer higher cost-performance ratios and lower travel costs. More and more people are looking for such choices.

At the auto show, seven out of the top ten car manufacturers in terms of order volume were Chinese companies. Their products are not only fuel-efficient but also feature innovative designs. Although BYD's sales have slightly decreased compared to last year, GWM, MG, and AION are starting to catch up. This represents a healthy market landscape. Without the dominance of a giant like Toyota, we are able to enjoy high-quality products at competitive prices.

If any infringement occurs, please contact us for deletion

Trending News

BYD to unveil new technologies on March 5, 2026 – pure EV range to exceed 1,000 km

This isn’t about a new model debut. Instead, BYD is preparing to showcase a suite of near-production core technologies – including a pure EV boasting a CLTC range of over 1,000 km, an upgraded Megawatt Flash Charging 2.0 system, and the next-generation DM 6.0 Super Hybrid platform.

2026 New Proton S70 Upgrades from Three-cylinder to Four-cylinder, Significantly More Powerful!

Proton's 2026 S70 to be launched before Lunar New Year, with a key upgrade to a 1.5-liter four-cylinder turbocharged engine replacing the three-cylinder model, improving power smoothness, maintaining spaciousness, with the infotainment system and driver assistance possibly adapted to local road conditions, offering practical improvements tailored to the needs of Malaysian and Thai family users, aiding car purchase decisions.

In 2026, Should I Buy a Proton X50 or a Perodua Traz? Can the RM 6,000 Rebate Offset the Traz's Space Advantage?

Recently, one of the most frequently asked questions in the Malaysian market is: So, should you go for the Proton X50, which offers stronger performance and a greater sense of technology, or the Perodua Traz, which provides more space and is more budget-friendly? Especially considering the X50 has discounts of up to around RM 6,000, how significant is the price difference left to weigh? This article provides an objective analysis from the perspective of daily usage.

Toyota Estima to return in 2026?

Since it was discontinued in 2019, news about the return of the Toyota Estima to the market has never stopped. Although Toyota has not yet released any official announcements regarding mass-production vehicles, the related information does not come from scattered rumors but originates from continuous revelations by Japanese automotive media.

Donut Lab Announces Mass-Produced All-Solid-State Battery, Claims 5-Minute Full Charge

All-Solid-State Battery, which has long remained in the laboratory and concept stages, is now approaching a true commercialization milestone. Donut Lab announced that its All-Solid-State Battery is ready for mass production and will be first equipped on the Verge TS Pro electric motorcycle.

Popular Cars

Model Year

Car Compare

Car Photo